aurora sales tax rate

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. There is no applicable special tax.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

. 2020 rates included for use while preparing your income tax deduction. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

The latest sales tax rate for Aurora MN. This rate includes any state county city and local sales taxes. For tax rates in other cities see Missouri sales taxes by city and county.

If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. 2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax deduction.

All services are provided electronically using the tax portal. The Aurora sales tax rate is 375. The December 2020 total local sales tax rate was 8350.

The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city sales tax. The sales tax jurisdiction name is Venice which may refer to a local government division. In no event shall the amount of tax to be held be less than 375 400 in Arapahoe County of 50 of the permit fee determination assessment.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. 2020 rates included for use while preparing your income tax deduction.

The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Tax and Licensing Calendar. The latest sales tax rate for Aurora SD.

The latest sales tax rate for Aurora MO. This rate includes any state county city and local sales taxes. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

You can print a 9225 sales tax table here. Did South Dakota v. An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80011 80012 80014 and 80019.

What is the sales tax rate in Aurora Colorado. The latest sales tax rate for Aurora CO. The Aurora Sales Tax is collected by the merchant on all qualifying sales.

The December 2020 total local sales tax rate was also 5500. The minimum combined 2022 sales tax rate for Aurora North Carolina is. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 7375. The Colorado sales tax rate is currently 29. The December 2020 total local sales tax rate was also 0000.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 8000.

The latest sales tax rate for Aurora OH. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe County. The December 2020 total local sales tax rate was also 8250.

This rate includes any state county city and local sales taxes. This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Aurora Colorado is 8.

The County sales tax rate is 025. Special Event Tax Return. A one page summary of Aurora tax rates can be found below.

0375 lower than the maximum sales tax in MO. You can print a 8 sales tax table here. This is the total of state county and city sales tax rates.

The latest sales tax rate for Aurora OR. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. 2020 rates included for use while preparing your income tax deduction.

Avalara provides supported pre-built integration. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. File Aurora Taxes Online.

Aurora collects a 16 local sales tax the maximum local sales tax allowed under Utah. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. What is the sales tax rate in Aurora North Carolina.

The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax. The Aurora Sales Tax is collected by the merchant on all qualifying sales. There is no applicable city tax or special tax.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Contact Us Tax Division. This rate includes any state county city and local sales taxes.

The latest sales tax rate for Aurora IL. This rate includes any state county city and local sales taxes. 0875 lower than the maximum sales tax in NY.

There are approximately 213758 people living in the Aurora area. The December 2020 total local sales tax rate was 7250. 2020 rates included for use while preparing your income tax deduction.

2020 rates included for use while preparing your income tax deduction.

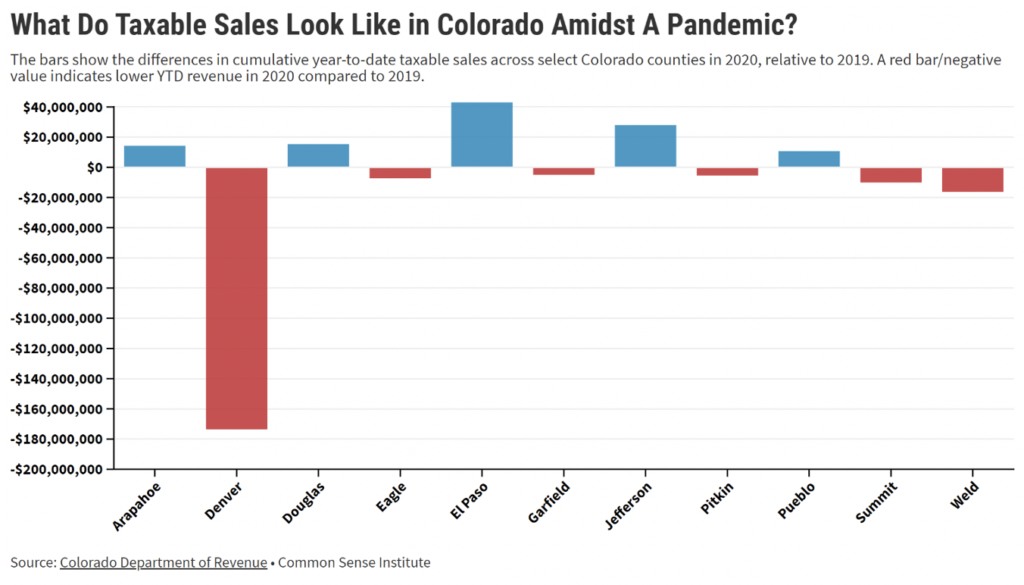

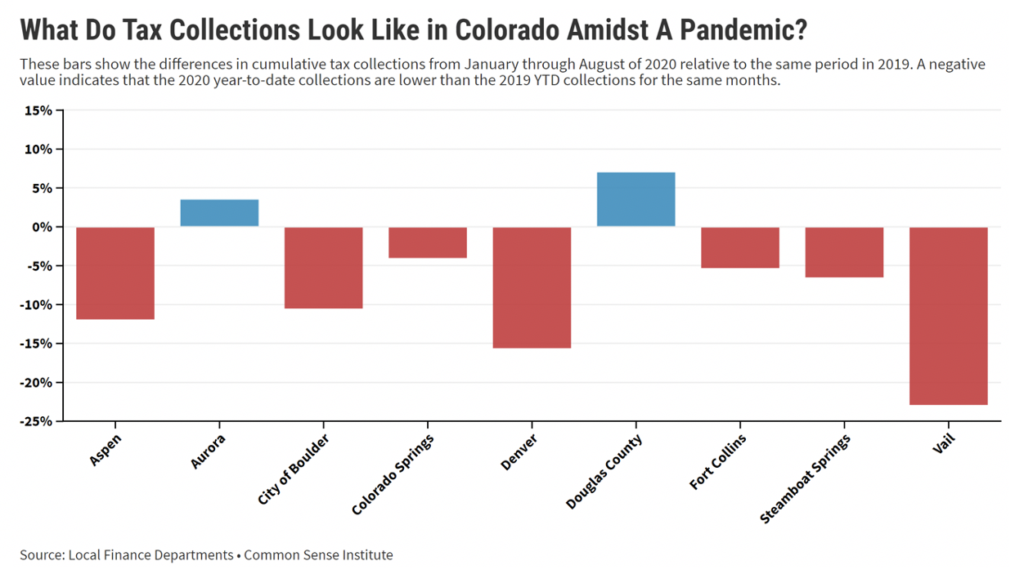

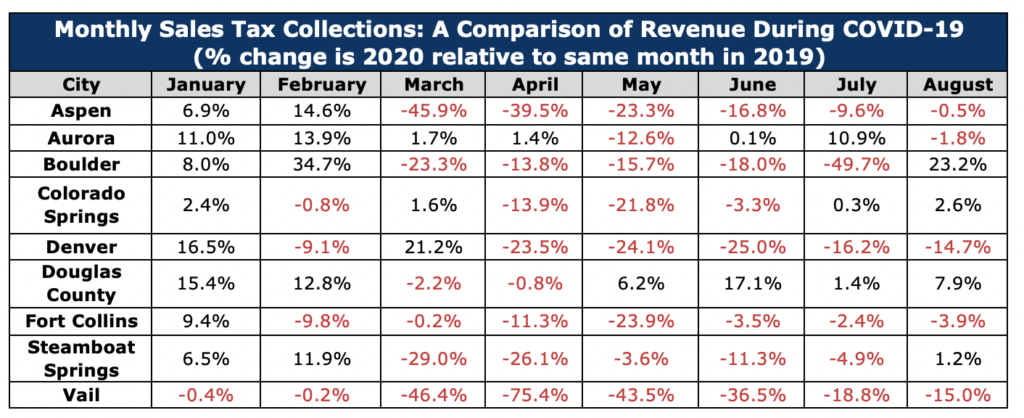

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Kansas Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725

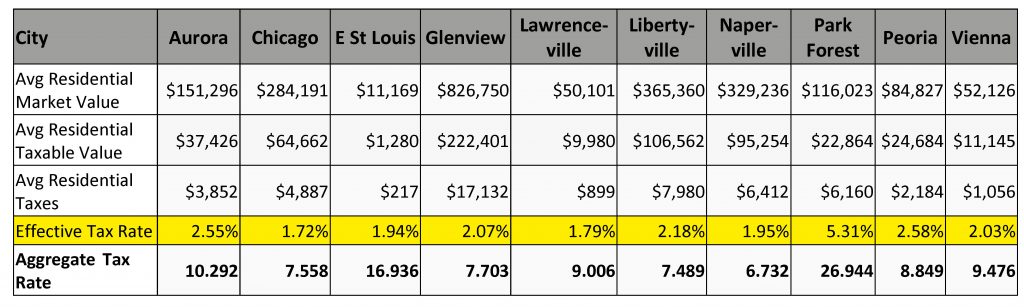

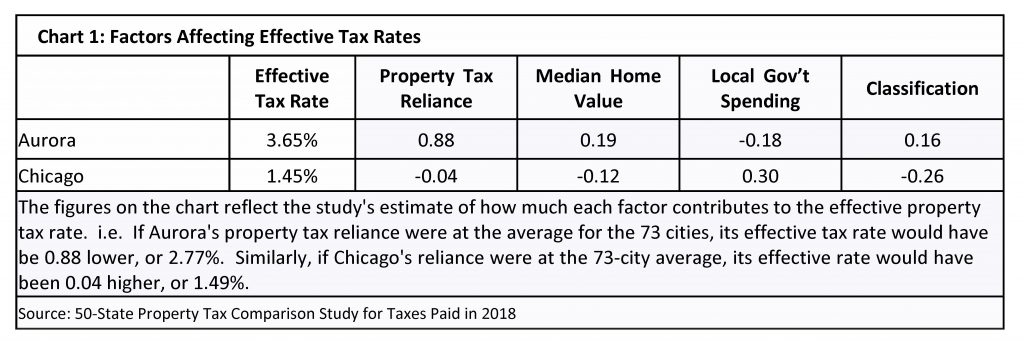

Taxpayers Federation Of Illinois Aurora Tops In Effective Tax Rate Low In Local Government Spending Mike Klemens

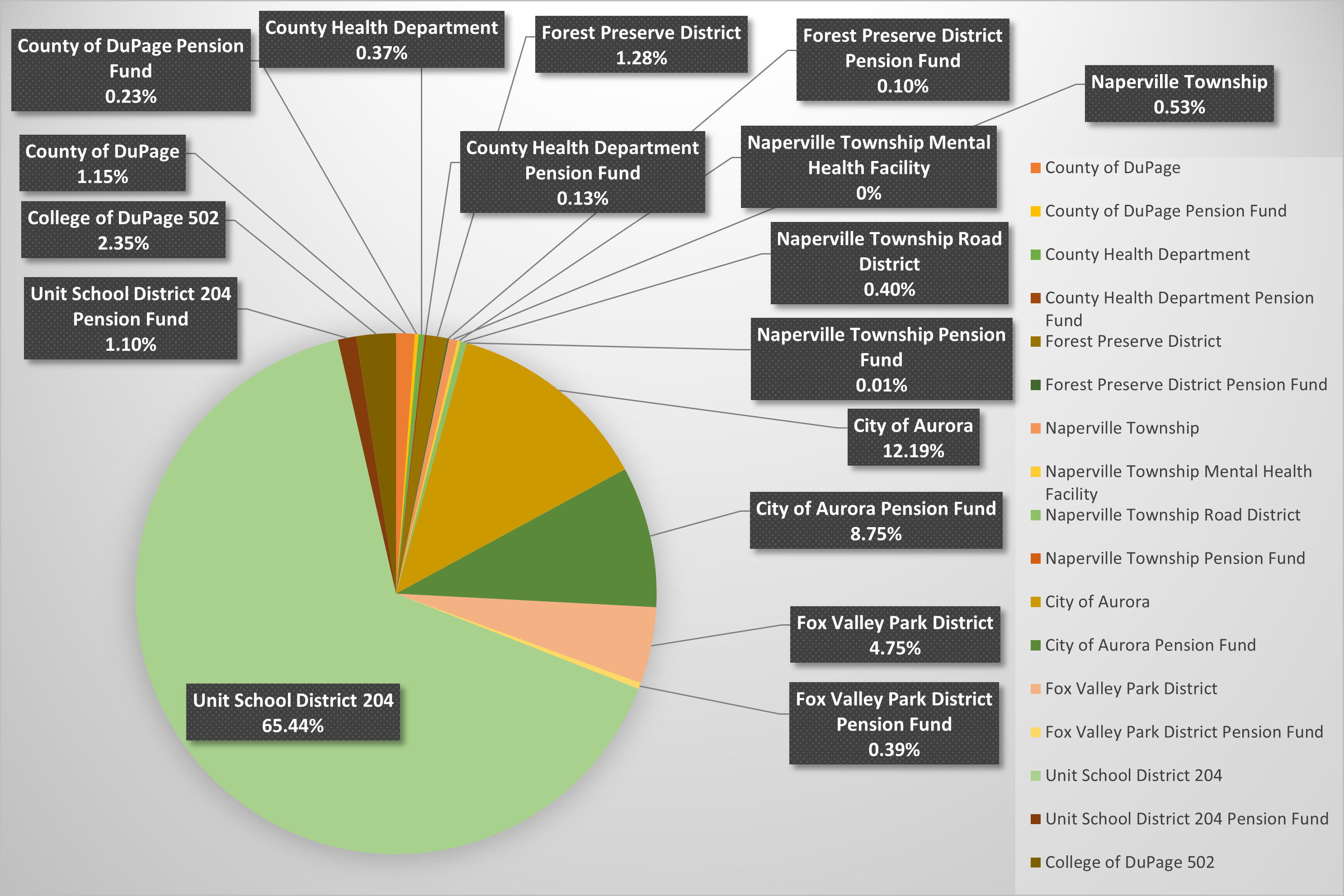

Where Do Property Taxes Go Assessor Naperville Township

How Colorado Taxes Work Auto Dealers Dealr Tax

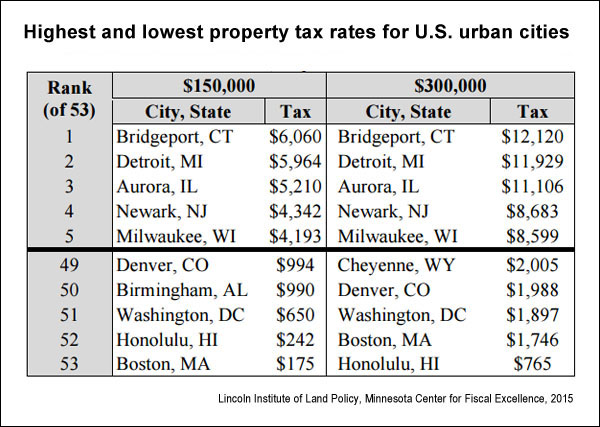

U S Property Taxes Comparing Residential And Commercial Rates Across States

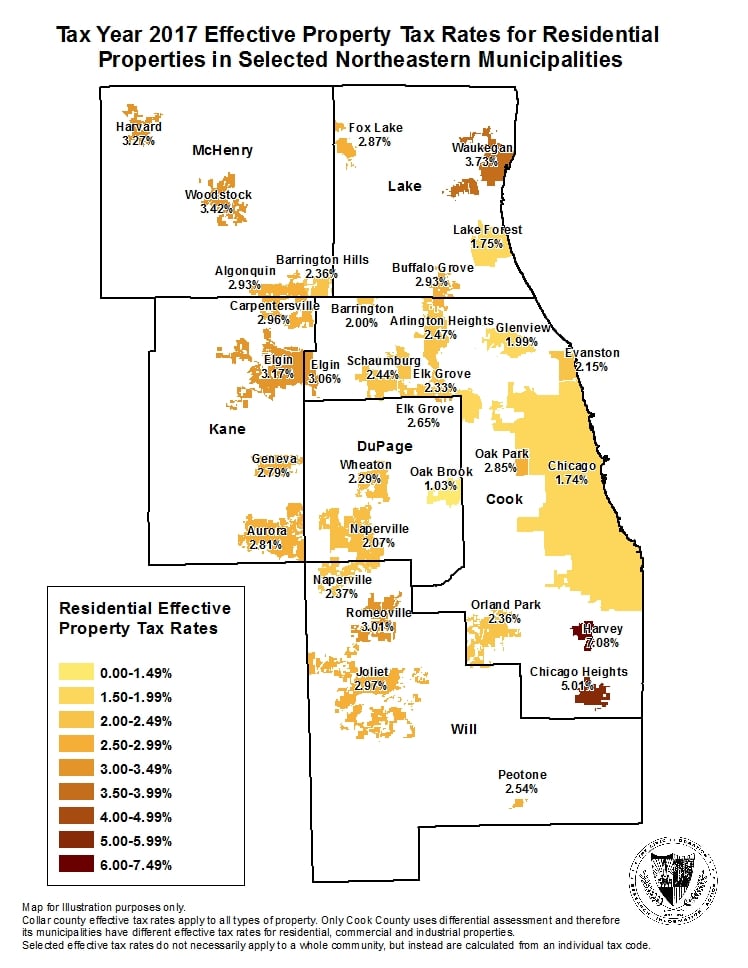

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Taxpayers Federation Of Illinois Aurora Tops In Effective Tax Rate Low In Local Government Spending Mike Klemens

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Nebraska Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora Kane County Illinois Sales Tax Rate

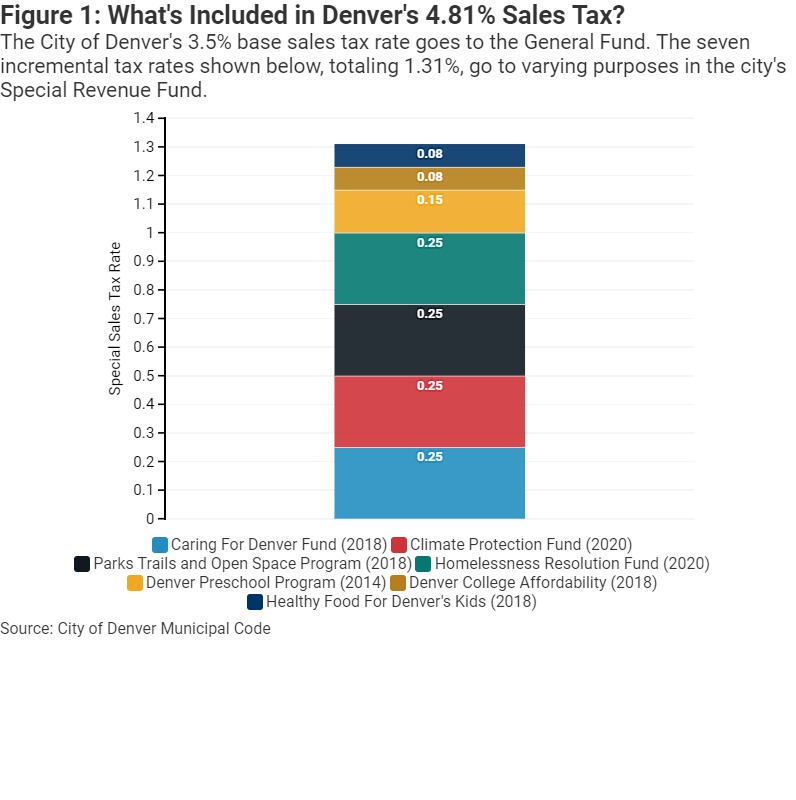

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute